Below: 4 Case Studies of the Palmer Creative Group & A Run-Down of Qualifications in Marketing for your review.

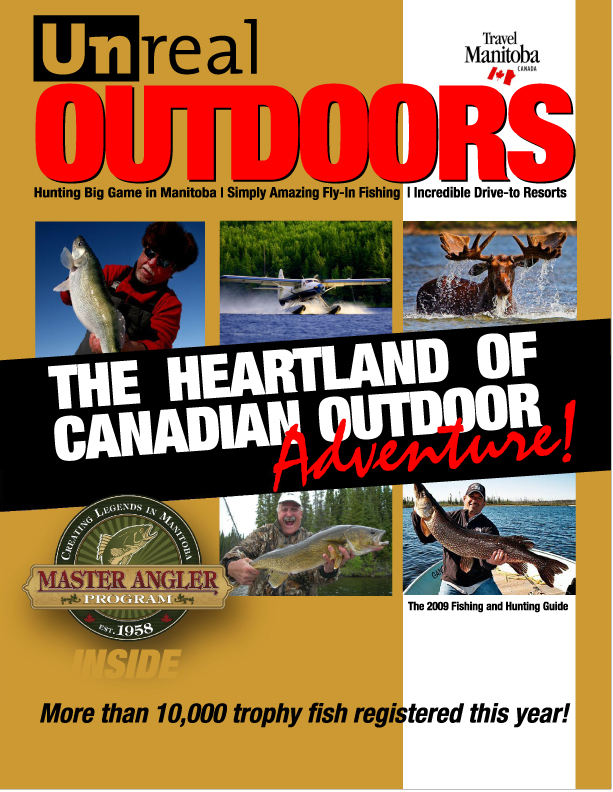

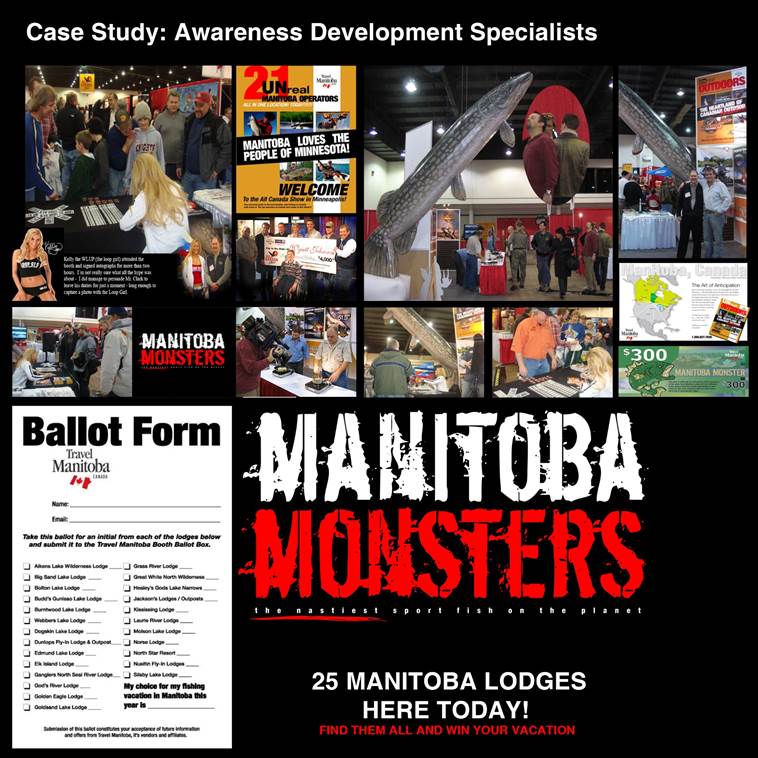

Case Study #1 The Fish/Hunt Program at Travel Manitoba

Tactical Marketing Strategy: Meet the operators, hear their concerns, write down all concerns, meet with the Government Tourism Agency, discuss operators concerns, create a survey which will be delivered personally over the phone by me to get a feel for the end-users (fishing/hunting clients in the Mid-West USA primarily) Ask the 20 questions and record all answers onto survey form for each end-user questioned. Tabulate the results (350 surveys were done over a 1 year time period) Knock off the highs and lows and arrive at the opinions of the masses. Derive a working promotional strategy using the information from these best customers of our Lodges and Outfitters. Sponsor the key shows in each of 10 US-Midwest markets. Apply the same strategy to print, tv, radio, outdoor billboards, create brochures to be handed out at the door for each market – customized to each market, gauge effectiveness of our work, design massive booth and have Show Management set it up and take it down at each venue, build a 22′ fish to attract attention, rebrand the thing “Manitoba Monsters” – referring to the massive fish/hunt opportunities. Lead the market – repeat yearly, always with fresh new ideas gained from year before.

Case Study 2 – Marketing Lead at Abitibi Geophysics

Here, Abitibi Geophysics CEO Pierre Berube pours through survey documents along with the actual quotations from the clients about Abitibi’s services. The surveys provide helpful insights to creating a marketing plan including media plan, trade show planner and competitive research. The information is then tabulated, extreme points are removed leaving us with an “average” client in one field or another. Pierre was just excellent with this information, sticking with the recommendations proved to be tricky with many whispers in the background not understanding that the ideas actually came from best clients…

To Whom It May Concern

“My name is Pierre Berube, I am the President and CEO of Abitibi Geophysics. I write to you today on behalf of John Kevin Palmer, who was employed as our Executive Vice President for a number of years. Together, Kevin and my company, Abitibi Geophysics, have moved markers quickly – including, but not limited to:

• detailed surveys of our best clients

• a detailed and thorough marketing plan was created including SWOT analysis, customer input throughout, media planning, product development guidelines

• a detailed evaluation of our operations including a review of our bid process, power point materials, all web site data, video and brochure reviews

• a complete revamp of every single marketing and sales material

• assistance with all new product introductions

• new software which initially launched automated email campaigns

• new media has been created using his photography, video, design and writing abilities – producing these materials with high quality and a minimum of outsourcing. I did however always ensure that a geophysics expert assisted with these productions.

Kevin has been a vital cog in this wheel, massively introducing our new “main brands” to scores of new clients never aware of Abitibi Geophysics before. To summarize, Kevin has treated Abitibi Geophysics as though it was his own company.Should you require further information, please call me during business hours at 819-874-8800

Thank You, Pierre Berube, Abitibi Geophysics

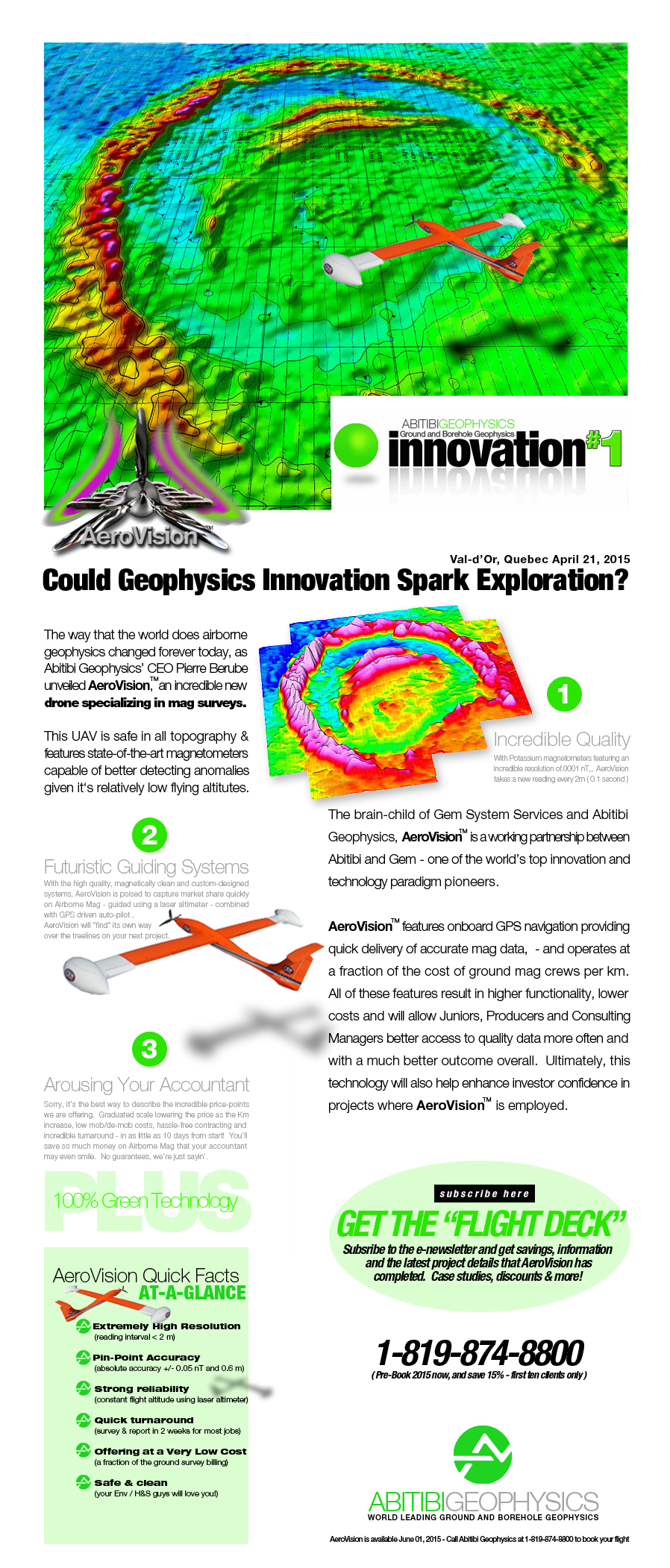

Case Study #3 – Impact of Graphic Design and Adhering to Best Client Recommendations:

Careful Graphic Design was used to ensure complete read-ability despite the relative complexity of the concepts. Crafted over many hours, this single sheet of work was responsible for generating tens of thousands of dollars in RFQ for the client, the result was a gain in top of mind awareness, revenue generation and a separation from the rest of the pack for Abitibi Geophysics.

Case Study 3 – CoreSafe Core Trays

This was a perfect case for doing a survey of the past best clients to gain information and sales research. As the lead person in Canada, I should have caught several errors that I was making, didn’t catch the errors.

It turns out, the wooden core boxes were costing Mining Producers $7 per box – and, if you know mining – it’s very difficult to transition them away from processes and procedures that they’d been using for years. The Coresafe trays were around $20/per unit.

What did I totally miss?

1. There are no geo-technicians in Australian business models -$200,000/yr.

2. North American business model has core constantly moving – by hand. A technician lifts the boxes from pallet to exam table then from exam table to storage rack then back to exam table then back to storage rack then carried over to the saw then carried to the permanent storage in vertical racks – often overhead lifting required. This is about 40% slower than the Australian model: where core is lifted by two geologists placed onto roller racking and left in place the entire time.

3. They (Australian’s) are often able to log 4,000 metres a week using this system or about 1/2 the time of North American logging. Essentially, this therefore doubles the cost of logging in North America. ( 4 geos x 40hrs/week x 52 weeks @ $60/hr: $499,200 total to do 104,000 metres of logging per year. The Australian model is $499,200 to do 208,000 metres of logging per year.

4. Add the $200,000 in North America for geo-tech lifter folks and it costs $700,000 in North America vs $499,200 in Australia. Doing the math on the cost per metre: North America: $6.73/metre logged Vs Australia at $2.43 per metre – or about 1/3 the cost. Sprinkle in the lost-time injuries in the core shack from needless lifting / twisted backs / pulled muscles – and the resulting increase in Workplace Insurance costs of about 30% – and this is a total no brainer. The cost of the core trays are irrelevant after seeing this – and, just a little automation makes long-term storage with Coresafe Trays so much more simple: effective and protects the core for decades vs wood trays that last about 8 years in our North American climate. Once this is read, pretty tough to remain using wooden core boxes.

As an estimate only, a core shack would have to be built (Quans Hut) 80-100 ft long by at least 8 rows of roller racking (pallet holds 26 trays x 3′ each: 80′ long x 2′ wide: 4′ between rows= 60′ wide.

EMail: [email protected] for more info.

Case Study 4 – Enersoft and their GeologicAI Core Scanner

Here is a beautiful case for the power of Linked In. During a year and a half timeframe, I messaged, called, sent emails and produced revenue for this company in the millions of dollars. The introductions to the world were endless and as a result we landed the world’s largest gold mining company – Agnico Eagle. This represents a multi-million dollar sale and has blossomed into the company’s largest client. A testimonial to the power of Linked In as well as testimonial to the power of effort, discipline and tenacity. Let’s just say, we didn’t win at first at all. Proud of this one.

“To whom it may concern- Kevin Palmer provided business development services at GeologicAi from March 2020 to November 2021. I didn’t work directly with Kevin, but we became acquainted at weekly operation meetings. Kevin is a good listener, with cooperative and optimistic demeanour which I enjoyed. His main task was introducing mining companies to GeologicAi laboratory services and equipment. Kevin’s promotion skills contributed to GeologicAi growth in the mining services sector during his tenure. I would recommend Kevin for business development roles based on his proven ability to quickly execute on your sales strategy with energy and enthusiasm.

Martin Trobec P. Geol.

Let’s discuss your project’s marketing and advertising needs. Call us at 1.807.625.1441 today.